Evidence continues to mount that micro, small, and medium enterprises (MSMEs) represent the lifeblood of Ghana’s economy. This view has been re-echoed not only by international organizations such as the World Bank and International Trade Centre but backed by studies conducted by local research institutions such as the University of Ghana’s Institute of Statistical, Social and Economic Research.

These businesses play a vital role in driving economic growth, creating employment opportunities, and contributing to poverty reduction. In advancing this mandate, MSMEs would require adequate funding from financial institutions in the country.

The ability of MSMEs to access finance with relative ease and without the requirement for collateral, therefore, has become a pivotal issue and decisive factor of inclusion and participation in the MSMEs space, especially for women and youth.

Now more than ever, dealing with the challenges that hinder these businesses from accessing financial support must be of utmost concern – a central action point for all who genuinely value and seek to advance the principles of equitable and inclusive growth.

And yet, access to finance remains a major challenge for many MSMEs.

Many businesses lack the ability to raise the needed security required by banks in order to successfully access credit. According to the World Bank, low access to finance among Ghanaian MSMEs is worsened by the high cost of financing as the high rates of borrowing make it impossible for MSMEs to sustain profitability over the long term. By the end of first quarter in 2023, the Interest Rate Indicator of Bank of Ghana showed an average lending rate of 35.87% among commercial banks.

In addition to this, recent World Bank reports have established that MSMEs face very high collateral requirements in the form of cash and cash equivalents including landed property which they mostly do not have or own. In response to these challenges outlined above, the Absa Young Africa Works project, with the support of Mastercard Foundation has taken a bold step in addressing the collateral requirement by scaling collateral-free lending.

The project aims to transform access to finance for MSMEs and drive the growth of women and youth-owned businesses across the country.

Why is this important for MSMEs in Ghana?

Traditional lending practices among financial institutions often involve some form of collateral, making it somewhat difficult for MSMEs, especially those in the informal sector, to secure loans. Most banks in Ghana have had to emphasize collaterals due to widespread challenges with creditworthiness of businesses.

Across the banking landscape, only a sufficiently positive customer historic borrowing conduct can provide the required level of comfort for banks to lend in lieu of security.

But for most MSMEs, such financial records are often lacking. A more intentional and careful look at the situation will likely establish the fact that collateral requirement can disproportionately affect women and youth entrepreneurs who often lack the necessary assets to deposit as security. As a result of customary practices, women in some parts of Ghana are not financially capable and are not adequately supported to purchase or own properties in their own names. Young people between the ages of 20 and 25 have either not successfully run a business long enough or mobilized sufficient resources to own assets to use as collateral. Consequently, a barrier is created as many promising businesses are unable to access the capital needed to expand operations. If businesses cannot access working capital, then their growth and job creation potential cannot be confidently projected or evaluated.

Whatever the case, the fact remains that uncollateralized lending offers a lifeline to micro, small and medium enterprises by providing access to finance based on the strength of their business models, financial history, corporate governance practices and growth potential rather than tangible assets that many of these businesses lack.

Building the capacity of MSMEs and supporting them to access collateral-free loans is therefore essential.

Scaling lending limits

A rapid scan of the banking landscape showed that prior to 2023 very few banks in Ghana offered unsecured business loans, and some of those that offered such products typically effected under-six-figure credit exposures.

On the other hand, however, the Absa Young Africa Works project has been at the forefront of promoting collateral-free lending in Ghana with remarkable success. Since the scaling of this lending model, an increasing number of women and youth-owned businesses have been able to secure funding for their businesses.

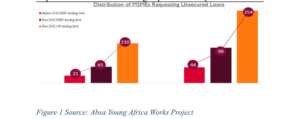

The project at inception in October 2020 – with the support of Absa Bank – set the lending ceiling at GHS500,000. By the end of 2022, the Absa Young Africa Works project lifted the ceiling further up to GHS1,000,000 which resulted in a noticeable surge in demand for lending support among MSMEs. This is because, the macro-economic challenges brought on by the COVID-19 pandemic adversely impacted the value of working capital for many businesses.

Evidence of impact

Since its commencement, the Absa Young Africa Works project has provided financial support to at least 617 MSMEs and more than 4,000 smallholder farmer businesses with a substantial portion of these businesses being owned and run by women.

Overall, 91% of loans given under the project were granted with no collateral requirement. The decision to champion uncollateralized lending has yielded remarkable results for women and youth-owned businesses across Ghana.

At least 67% of collateral free loans provided under the project supported businesses owned by women. Semer Prime Enterprise, a woman-owned business dealing in the sale of plastic products in the Bono East region of Ghana recorded over 300% growth in revenue less than one year after accessing financial assistance from the Absa Young Africa Works project. We found this remarkable for a business whose owner had earlier expressed apprehension about getting a loan to expand her business. She became convinced and availed her business for financial support only after learning about the subsidized interest rate of 10% and collateral free loan package made possible by the Absa Young Africa Works project.

There is even more impact arising from the dramatic uptick in MSME borrowing interest after the project revised upward the lending limit for unsecured loans. One year after the project was incepted, only four youth-led businesses had approached the project for financial assistance, receiving less than GHS500,000 in total.

By the second year of the project, at least 662 youth including smallholder farmers had received financial support. As the lending limit was augmented further to GHC1M, interest in business expansion increased, and so did the number of MSMEs double by the end of the third year. As of now – 7 months into year 4 of the project – more than 2,000 young people have been financially supported.

In effect, a major lesson for the Absa Young Africa Works project is the significant impact of raising the collateral-free lending ceiling from GHS500,000 to GHS1,000,000 particularly in driving the surge in participation from women and youth-owned businesses.

The Absa Young Africa Works project has gender and inclusion dynamics cutting across all stages of our change theory and implementation strategy.

Collateral-free lending further sheds light on the importance of inclusivity, which begins with stimulating the interest and confidence of our target MSMEs in accessing low-cost working capital, although these businesses would ordinarily rather avoid loans. Notably, 96% of female business owners, many of whom previously had apprehensions and were unsure about their capacity to repay loans, have now, on average returned at least twice to access collateral-free funding from Absa Bank.

We have found that effectively engaging unbanked MSMEs and providing easy and expanded access to needed capital generates interest and leads to businesses growth, and with growth comes sustainable livelihoods, especially for Ghanaian women and youth.

Business partners of some beneficiaries have testified of

the notable growth over the past three years facilitated by the Absa Young Africa Works project.

“We supply Adom Agro with fertilizer as well as pest and weed control products. In the past 6 months, I can say there has been like 60-70% increase in purchase requests by Adom Agro which is a huge jump compared to previous years. I think her growth has been tremendous, because when she started, I was here. She had only one shop, but now has many of them. She is now among my top two clients in Bono East, Bono and Ahafo regions combined”.

Daniel Timpabi (Sales Agronomist, Dizengoff Ghana – Techiman)

Sustaining the gains

There is no doubt that inclusive economic growth is possible for MSME business owners, and the success of the Absa Young Africa Works project’s uncollateralized lending initiative re-echoes this need to reimagine traditional Ghanaian lending practices toward more inclusive approaches.

Impact investors, financial institutions, and policymakers must become more intentional in recognising the potential of uncollateralized lending models as a viable mechanism for MSME development in Ghana. As of March 2024, the project has maintained a healthy loan portfolio with only a 0.1% default rate. This is proof that collateral-free MSME financing is feasible with minimal risk of loan non-performance.

Hence, impact investors seeking to catalyse true and lasting transformation in the human condition should consider incorporating this lending model into their strategies to support the growth of MSMEs.

We hold the view that to unleash the full potential of MSMEs and build a more resilient economy through revenue growth and sustainable job creation, we need to transform the financing landscape; we need to embrace innovative solutions including various unsecured lending models which have shown real potential as enablers of inclusion, participation, and revenue growth in the MSME sector.

The evidence clearly shows that for Ghanaian MSMEs, meticulous collateral-free lending is one key and proven way to go, and as we continue on this path, we can have confidence in our collective contribution to building Ghana’s future together, one MSME story at a time.